Working with Heath Benefit Partners

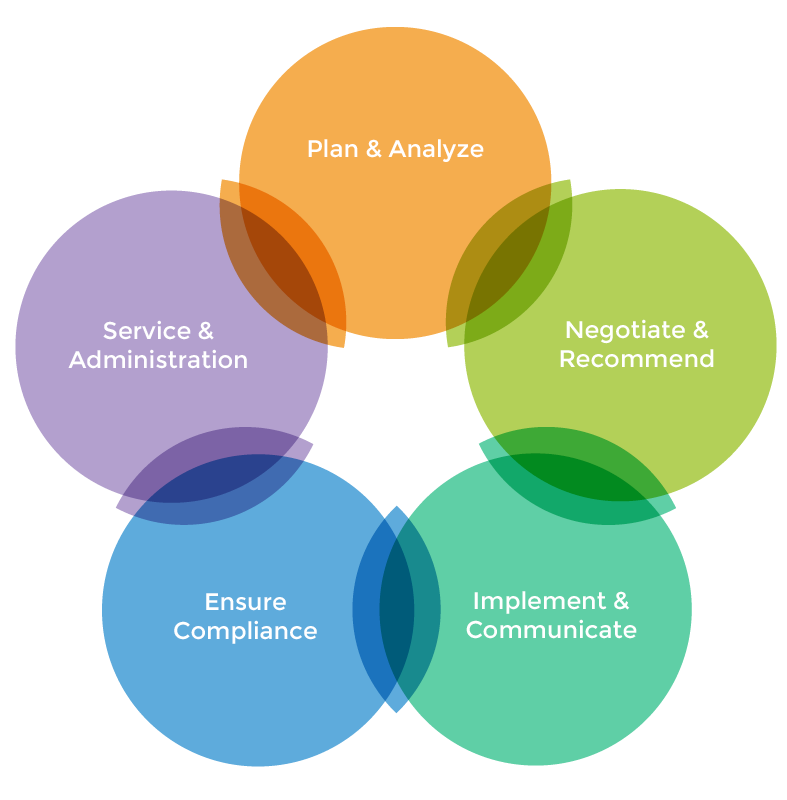

As a broker, not an agent, Heath Benefit Partners works for you and the needs of your organization – not on behalf of any insurance carrier. Our five-step strategic planning and implementation process is based on what large consulting firms do for their Fortune 500 clients. Our strategic planning process is comprised of Step 1 (Plan & Analyze) and Step 2 (Negotiate & Recommend). At this stage, we help you define the objectives you have for your employee benefits program, and we work with the insurance carrier marketplace to meet your goal. Steps 3-5 are all about implementation, compliance, and the kind of ongoing service that makes us an extension on of your HR department for administrative tasks all year long.

- Review current plan performance and analyze needs

- Check Affordable Care Act (ACA) compliance

- Define objectives – outline process for meeting those objectives

- Deploy program modeling tools to maximize your benefits investment while understanding employee utilization impacts

- Benchmark against peer businesses

- Survey employees, if applicable

- Develop and confirm benefits strategy

- Conduct thorough market analysis

- Vet options based on pricing, network, benefits, service and compliance

- Negotiate rate concessions

- Provide custom benefit enrollment literature, education and decision support

- Hold informative employee meetings, health fairs and other educational opportunities

- Provide online access to benefit summaries and enrollment materials

- Offer one-on-one access to benefit specialists

- Provide full service COBRA administration

- Offer ACA, COBRA, HIPAA notifications

- ERISA compliance support

- Complete implementation, administration, and discrimination testing of Section 125 plans

- Provide ongoing legislative updates

- Assist with Form 5500 filing

- Offer patient advocacy to resolve billing, claims, and enrollment issues

- Provide ongoing financial and plan performance analysis

- Access to online resource tools

- Process eligibility, enrollments and terminations year-round